Back

Project Financing & Investment

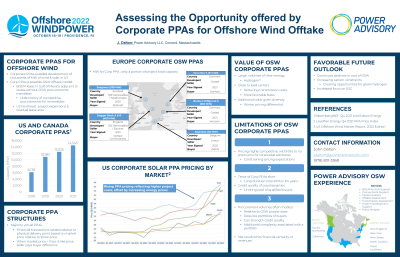

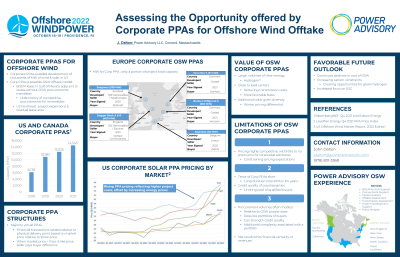

Assessing the Opportunity offered by Corporate PPAs for Offshore Wind Offtake

Tuesday, October 18, 2022

.jpg)

John C. Dalton, 30 years in electricity sector focusing on electricity markets (he/him/his)

President

Power Advisory LLC

Concord, Massachusetts

Presenter(s)

Presentation Description: In the US, offshore wind (OSW) project development has been driven by state procurement targets that have been underpinned by long-term PPAs awarded through competitive procurements. However, with the expansion of BOEM lease areas to federal waters (e.g., Gulf of Mexico) adjacent to states without such mandates and little history of competitive procurements for renewables resources, alternative means of securing offtake agreements will be required. One offtake model that has received widespread adoption is corporate PPAs, enabling the development of thousands of MWs of wind and solar in the US. The economics of these deals are compelling; the renewable technologies’ costs are typically less than wholesale market prices.

Corporate PPAs are enabling the development of OSW projects in Europe and Asia. This experience will be reviewed. In the US with lower wholesale electricity prices, the economics of OSW as a source of supply for a corporate PPA are less compelling. The presentation will then turn to the conditions required to support corporate PPAs for OSW project development in the US. This includes identifying additional sources of value for an OSW corporate PPA (e.g., hedge value, environmental attributes, ESG benefits). The presentation will close with the favorable long-term outlook for OSW enabled corporate PPAs, with continued declines in the cost of OSW, increasing carbon emission constraints and increased focus on ESG commitments.

Corporate PPAs are enabling the development of OSW projects in Europe and Asia. This experience will be reviewed. In the US with lower wholesale electricity prices, the economics of OSW as a source of supply for a corporate PPA are less compelling. The presentation will then turn to the conditions required to support corporate PPAs for OSW project development in the US. This includes identifying additional sources of value for an OSW corporate PPA (e.g., hedge value, environmental attributes, ESG benefits). The presentation will close with the favorable long-term outlook for OSW enabled corporate PPAs, with continued declines in the cost of OSW, increasing carbon emission constraints and increased focus on ESG commitments.

Learning Objectives:

- Key learnings are for participants are to understand: Favorable market conditions for corporate PPAs: pricing, liquidity Challenges posed by corporate PPAs including the importance of credit, securing viable offtake quantity Experience in Europe and Asia with offshore wind enabled corporate PPAs Opportunities and challenges of offshore wind enabled corporate PPAs in the US Longer term outlook for corporate PPAs for OSW sector

- see above

- See above